Figure out taxes on paycheck

Now you need to figure out your taxable income. In order to calculate your gross pay divide your total salary by the number of periods you work in.

Paycheck Taxes Federal State Local Withholding H R Block

Federal Salary Paycheck Calculator.

. Because Ohio collects a state income tax your employer will withhold money from your paycheck for that tax as well. If you make 20 per hour and work 40 hours a week for a yearly salary of 41600 you fall into the 12 federal income tax bracket for 2022. Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Enter your info to see your. The Federal or IRS Taxes Are Listed.

See how your withholding affects your. On a typical week you make 800 20 x 40 hours. Multiply the current Social Security tax rate by the amount of gross wages subject to Social Security.

Michigan city taxes apply whether you live or work in the city. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck.

How to determine gross income. This is 548350 in FIT. The California Tax Estimator Lets You Calculate Your State Taxes For the Tax Year.

This tax is based on the difference between your gross pay and your net pay. If we add up. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty.

Employers can use it to calculate net pay and figure out how. Adjusted gross income Post-tax deductions Exemptions Taxable income For post-tax deductions you. However the tax for non-residents is half the rate for residents in all cities.

As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. FICA taxes consist of Social Security and Medicare taxes. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. Gross pay is calculated for employees on hourly wage by multiplying the number of hours worked including overtime by the rate per hour. In Sallys example above her FICA withholding for each paycheck would be.

For starters all Pennsylvania employers will. Divide the sum of all applicable taxes by the employees gross pay The result is the percentage of taxes deducted from a paycheck Calculations however are just one piece of the larger. 69400 wages 44475 24925 in wages taxed at 22.

FICA taxes are commonly called the payroll tax. It can also be used to help fill steps 3 and 4 of a W-4 form. The most common rate used by 20 of the 24 cities.

However they dont include all taxes related to payroll. How to calculate your paycheck This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. On the other hand if you make more than 200000 annually you will pay.

15 Tax Calculators. Without the help of a paycheck calculator its tricky to figure out what your take-home pay will be after taxes and other monies are withheld. This is tax withholding.

In addition you need to calculate 22 of the earnings that are over 44475. Unlike adjustments and deductions which apply to your income tax credits apply to your tax liability which means the amount of tax that you owe. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into.

As mentioned above Ohio state income tax rates range from 0 to 399. For example if you calculate. Your employer withholds a 62 Social Security tax and a.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Online For Per Pay Period Create W 4

How To Calculate Taxes Using A Paycheck Stub The Motley Fool

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Payroll Tax What It Is How To Calculate It Bench Accounting

Understanding Your Paycheck

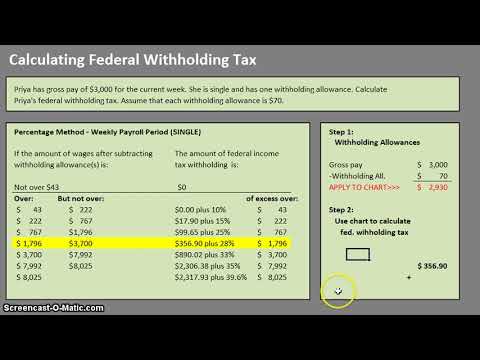

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Paycheck Calculator Take Home Pay Calculator

Understanding Your Paycheck Credit Com

Paycheck Calculator Take Home Pay Calculator

How To Calculate Federal Withholding Tax Youtube

How To Calculate Federal Income Tax

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

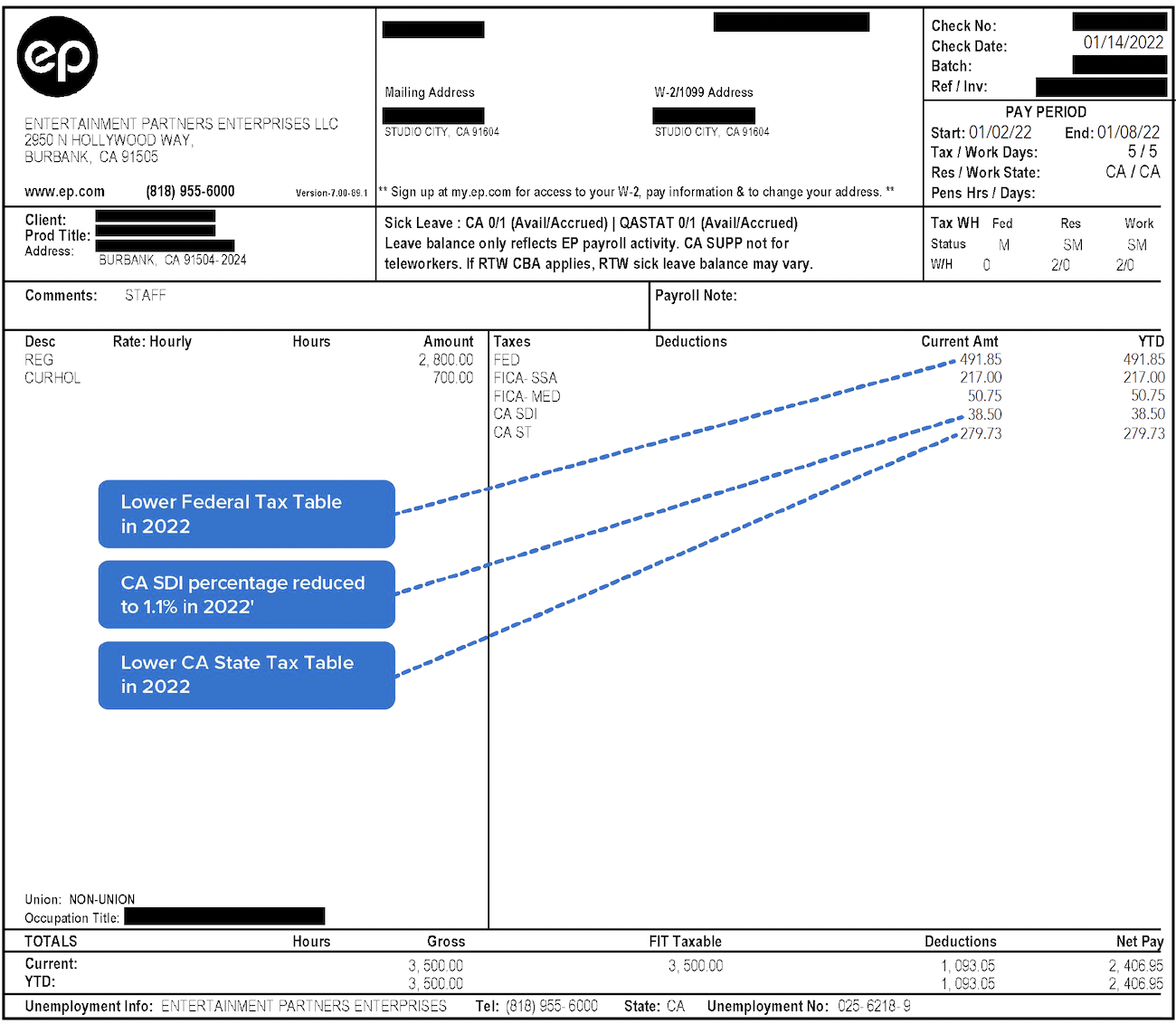

Decoding Your Paystub In 2022 Entertainment Partners

Different Types Of Payroll Deductions Gusto